Looking Good Info About How To Apply For Tin Id Philippines

If you are applying under e.o.98, you will need bir form 1904.

How to apply for tin id philippines. Attach your 1x1 picture and sign your tin card. Ask the officer where you can get your tin id card. Accomplish bir form 1902 and submit the same together with the documentary requirements to the employer.

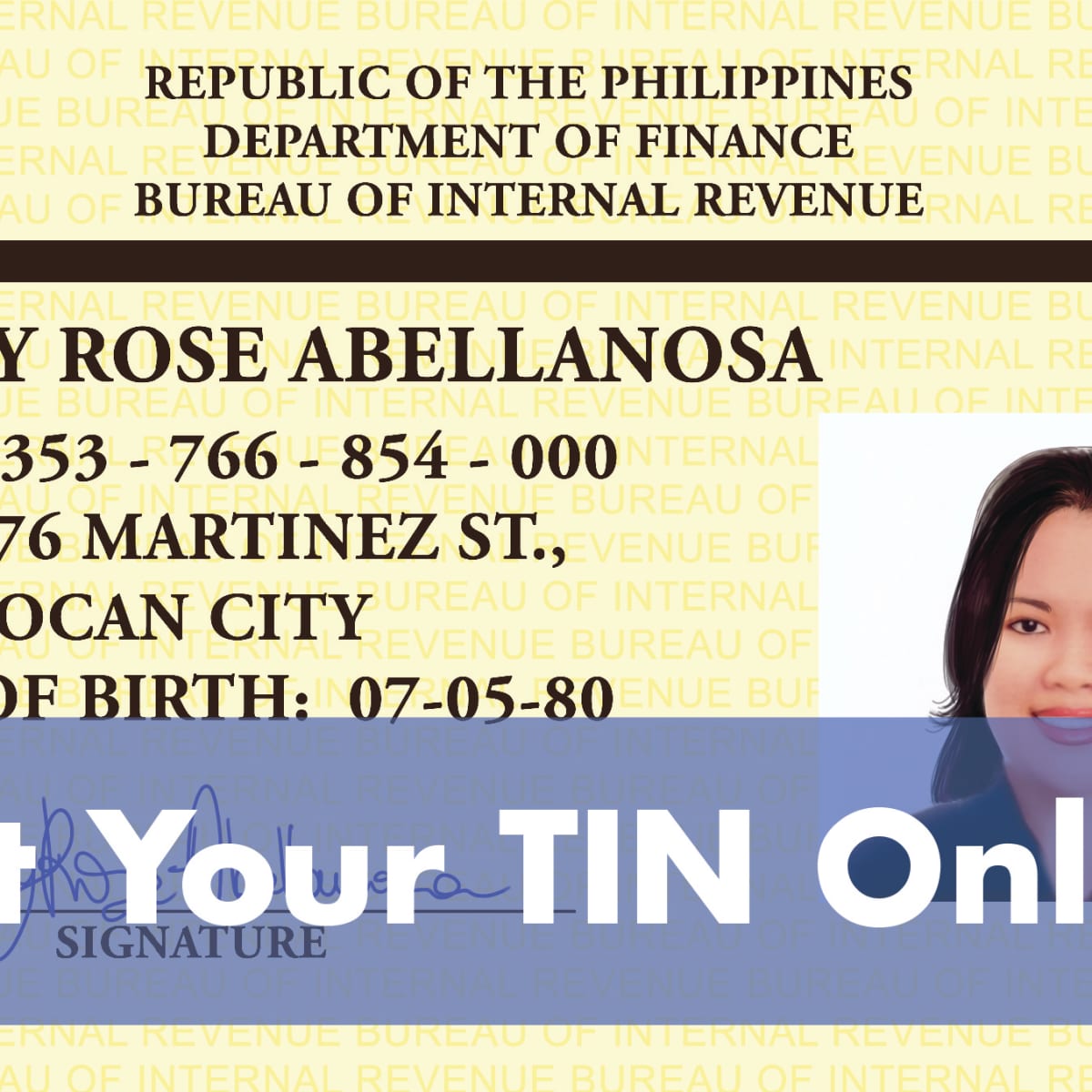

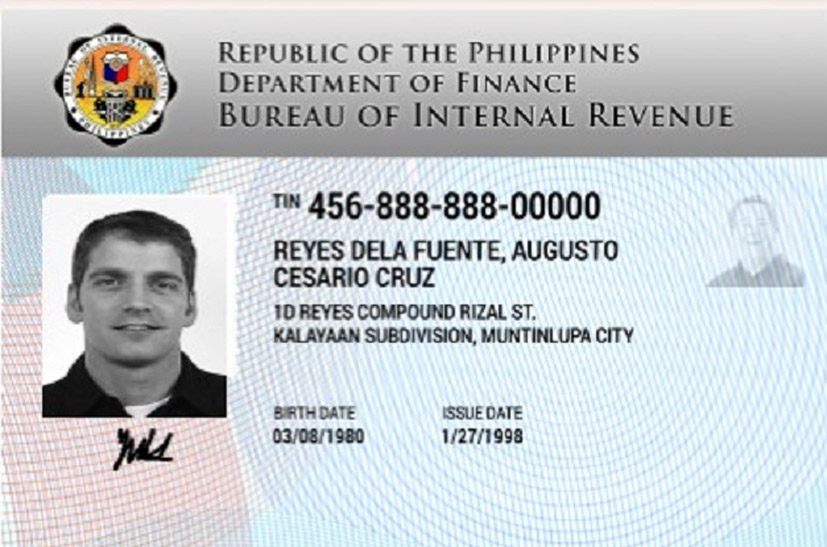

Requirements, procedure, fees, and everything you need to know. Applying for your taxpayer identification number (tin) ofws can apply for a tin in the philippines simply by visiting the nearest bir office and providing the following requirements:. Get your tin id card, be a registered taxpayer.

Pdf 2018 encs | pdf 2000 encs ) and submit it along with your proof of identities (valid ids). You are required to personally appear in the. However, if it was filed by your employer, you can get it from them.

One of the best ways to apply for a tin id in the philippines is to let your employer take care of it. Proceed to the same rdo on the date set by the personnel and claim your id. Application for a tin is free for individuals.

You can register for a tin number and apply for a tin id card at the revenue district office in the city where you’re residing. A tin id is an. If you already have a tax identification number (tin), simply visit the bir rdo to apply for a tin id card.

Businesses and those with mixed incomes, however, may be required to pay a registration fee. Whether you are starting a business or applying for your first job, you need to. Application for taxpayer identification number (tin) 1.